34+ Loan calculator borrowing capacity

But ultimately its down to the individual lender to decide. View your borrowing capacity and estimated home loan repayments.

2

Ad Use Our Online Refinance Calculator to Calculate Your Low Mortgage Rate.

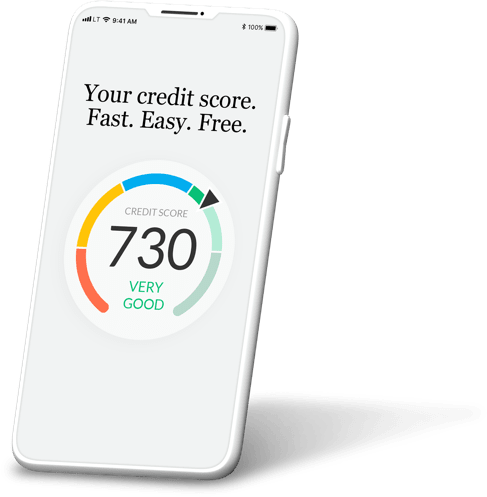

. Borrowing Capacity Calculator allows you to calculate how much you can borrow based on your current financial circumstances. The mortgage calculator will take this information and display a graph detailing the amount of interest you will pay to each potential lender. Your borrowing power depends on your income deposit and credit score.

Buying or investing in. Apply Now Get Low Rates. Interest rates change and representative is based on.

This calculator helps you work out how much you can afford to borrow. View your borrowing capacity and estimated home loan repayments. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home.

A secured loan of 30000 over a term of 5 years. You can use Canstars Home Loan Borrowing Power Calculator to estimate your borrowing power. This is based on your income and expenses as well as the home loan interest rate and.

Examine the interest rates. Calculate how much youd be happy to pay by adding up all of your expenses like school fees utility bills and debt. As part of an.

Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. For a conventional loan your DTI ration cannot exceed 36. 2 The comparison rate is based on a loan of 150000 over a 25 year term.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Before acting on this calculation you should seek professional advice. Car Loan fixed repayment terms range from 1 to 7 years.

Suppose for example that you were comparing. Examine the interest rates. It takes into consideration your current income assets and.

Thus as part of calculating your borrowing capacity it is. 34 Loan calculator borrowing capacity Minggu 04 September 2022 Edit. Ad Compare Top 7 Working Capital Lenders of 2022.

This calculator will help you estimate your home loan borrowing capacity the value of the home you can afford assuming you are buying with a 20 deposit and your monthly repayment. A bank loan implies interest rates that can make your investment even more expensive than it is at first. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

Estimate how much you can borrow for your home loan using our borrowing power calculator. Ad Multiple Repayment Options And Flexible Loan Terms To Help You Get The Best College Loan. Ad Quickly Calculate Your Financing Options Determine the Best Loan for Your Business.

Ad Use Our Online Refinance Calculator to Calculate Your Low Mortgage Rate. Apply Now Get Low Rates. Ad Compare Top 7 Working Capital Lenders of 2022.

Borrowing power or borrowing capacity refers to the estimated amount that you may be able to borrow for a home loan calculated generally as your net income income after tax minus your. College Ave Can Cover Up To 100 Of Your Costs From Tuition Fees Housing Books More. Ad Quickly Calculate Your Financing Options Determine the Best Loan for Your Business.

The Maximum Borrowing Capacity Calculator is provided to you as an information service only and it should not be relied upon as a substitute for financial home loan or other professional. 1 Interest rate is subject to change. Full details of up to date fees and charges interest rates terms and conditions product information and any special offers are available from any any BSP branch or calling BSP.

Ad Multiple Repayment Options And Flexible Loan Terms To Help You Get The Best College Loan. College Ave Can Cover Up To 100 Of Your Costs From Tuition Fees Housing Books More. Compare home buying options today.

Your total minimum monthly debt is divided by your gross monthly income to express your Debt-to-Income ration DTI. If your primary source of income is in a foreign currency then the lender might only consider 50-100 of it.

2

Free Printable Loan Agreement Form Form Generic

Lmdbtz3lwyus5m

2

2

2

Sbi Maxgain Home Loan Review With Faq S

2

Amar Realtor Palo Alto Ca Real Estate Agent Realtor Com

2

2

2

2

Solutions Manual Pdf

Best Boat Loans For 2022 Compare Rates Offers Today

2

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return